In the ever-evolving landscape of investment opportunities, identifying the right assets can make a substantial difference in achieving remarkable returns. Among the various investment strategies, one of the standout approaches is targeting "vertical baggers." These are stocks that have the potential to appreciate significantly, often demonstrating strong momentum and price increases. Investors looking to capitalize on such opportunities can benefit greatly from understanding how to spot and evaluate potential vertical baggers effectively.

To navigate this investment terrain successfully, one must become adept at recognizing the characteristics and market conditions that lead to vertical bagger performance. Key indicators often include emerging industry trends, innovative business models, and strong leadership that drive company growth. By conducting thorough research and analysis, investors can identify these promising stocks before they experience substantial price surges, ultimately maximizing their returns.

In this guide, we will explore strategic methods for identifying vertical baggers, the essential metrics to evaluate their potential, and the importance of timing in making successful investments. By equipping oneself with the knowledge and tools necessary to invest wisely, one can unlock the potential for significant financial rewards through vertical baggers.

Vertical baggers are a unique class of stocks that have the potential for substantial price appreciation, often characterized by their extreme upward momentum. Typically, these stocks experience significant price movements, frequently exceeding 100% returns in a relatively short time frame. According to reports from market research firms, vertical baggers are often found in emerging industries or sectors undergoing rapid transformation, such as technology and renewable energy. Their defining characteristic is the consistent upward trajectory, driven by strong fundamentals or market catalysts, differentiating them from traditional investments.

To identify vertical baggers, investors should look for stocks with unusual trading volumes, indicating heightened interest and potential momentum. Additionally, monitoring earnings reports and news developments is crucial, as positive announcements can trigger rapid price surges. Data from investment analytics platforms reveal that stocks with a solid track record of earnings beats and upward revisions in revenue forecasts tend to outperform their peers, underscoring the importance of diligent research. As investors increasingly seek high-growth opportunities, understanding the characteristics of vertical baggers becomes essential for maximizing returns in a dynamic market landscape.

Identifying potential vertical baggers requires a keen understanding of various key indicators that can signal a stock's potential for exponential growth. One of the primary indicators to consider is the company's revenue growth trajectory. Look for businesses that have demonstrated consistent revenue increases over several quarters. This sustainable growth often indicates strong demand for their products or services, positioning them for further expansion. Additionally, consider their market share within a rapidly growing industry; companies that are capturing a larger slice of an emerging market may be on the cusp of significant gains.

Another essential factor is the presence of a solid management team with a track record of successful execution. An experienced leadership team with a clear vision and a history of navigating market challenges can inspire confidence. Furthermore, pay attention to the company’s innovation pipeline. Firms that invest in research and development and introduce new products or services can create new revenue streams, boosting their growth potential. Lastly, evaluate market sentiment and analyst ratings, as positive outlooks from credible sources can indicate future upward momentum in stock prices.

Identifying and investing in vertical baggers requires a strategic approach that hinges on various key factors. According to recent reports from the financial industry, vertical baggers, defined as stocks that show consistent upward trends due to strong fundamentals and market positioning, can yield impressive returns. Data shows that during the last decade, stocks that qualified as vertical baggers delivered an average annual return of over 20%, significantly outpacing traditional market indices. Investors should focus on companies with robust growth potential, solid earnings reports, and a proven track record of innovation.

To effectively invest in vertical baggers, one must adopt a multi-faceted strategy. First, perform comprehensive market research to identify sectors experiencing rapid growth—such as technology, renewable energy, and biotechnology. Leveraging tools like financial analytics platforms can help in tracking key performance indicators (KPIs) and understanding market sentiment. Moreover, staying informed about macroeconomic trends and industry developments is crucial. A recent survey indicated that 65% of successful investors actively monitor economic indicators, allowing them to pivot their investments towards high-growth opportunities as market conditions evolve. By implementing these strategies, investors can enhance their ability to discover and capitalize on vertical baggers, maximizing their potential returns.

| Dimension | Value |

|---|---|

| Last 5-Year Growth Rate | 300% |

| Current Market Cap | $1.5 Billion |

| Price-to-Earnings Ratio | 25 |

| Dividend Yield | 2.5% |

| Analyst Rating | Buy |

| Total Debt to Equity Ratio | 0.5 |

| Market Performance (Year-to-Date) | +75% |

Investing in vertical baggers can yield significant returns, but it comes with its fair share of risks. Effective risk management is essential for any investor looking to capitalize on these high-potential opportunities. Key to this approach is diversification; spreading investments across various vertical baggers mitigates the impact of a single asset underperforming. By not putting all your capital into one option, you can cushion potential losses and stabilize your overall portfolio.

Another crucial technique is setting strict entry and exit points. Before investing, determine the maximum loss you are willing to accept and set an exit strategy accordingly. This will not only prevent emotional decision-making but also protect your investments from extreme volatility. Utilizing stop-loss orders can also help automate this process, ensuring you maintain discipline in your trading strategy.

Tips: Always conduct thorough research on any asset before committing funds. Understanding the market dynamics and the underlying factors that drive vertical baggers is vital. Additionally, revisit your risk management strategies regularly to adapt to changing market conditions, ensuring that your investments align with your financial goals and risk tolerance.

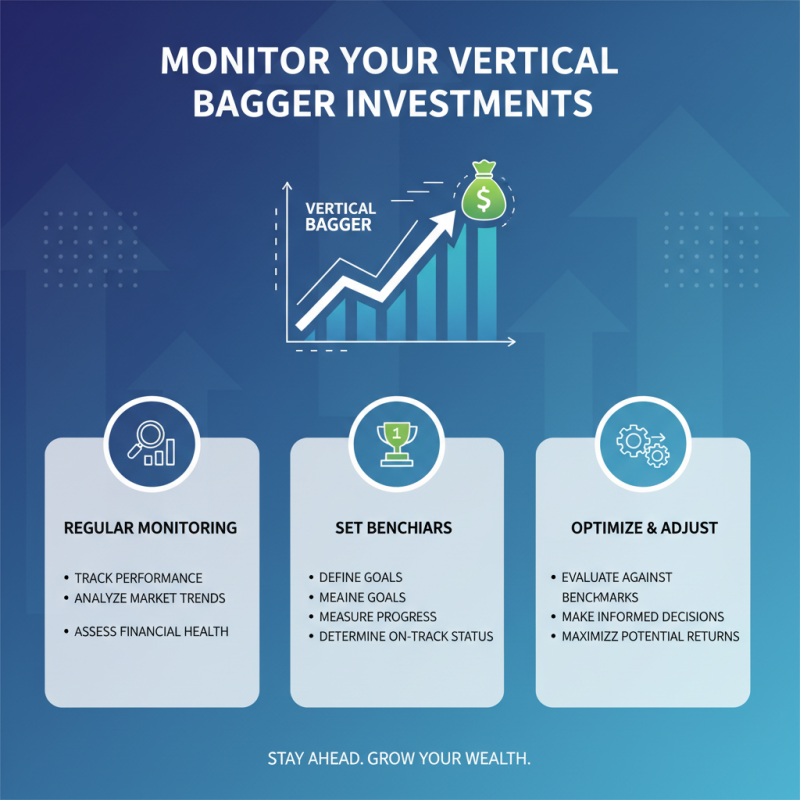

Monitoring your vertical bagger investment portfolio is crucial for maximizing your returns. A vertical bagger refers to a stock that has the potential to appreciate significantly over time. Regular monitoring allows you to assess the performance of your investments based on market trends, financial health, and performance indicators. Establishing benchmarks for your investments can help you determine whether they are on track to achieve the desired returns or if adjustments are necessary.

Adjusting your portfolio should be a proactive process. This means not only selling off underperforming stocks but also reinvesting your gains into new vertical bagger opportunities. Keeping abreast of industry news, earnings reports, and broader economic indicators will enable you to make informed decisions. Additionally, consider diversifying your investments across different sectors to mitigate risk while still capitalizing on vertical bagger potential. Regular portfolio assessments facilitate timely adjustments that can enhance growth, leading to greater overall profitability in your investment journey.