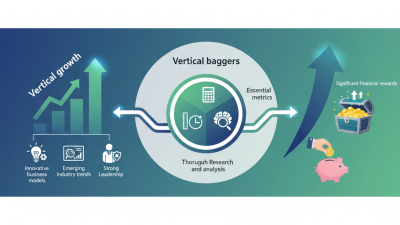

In the dynamic world of investment strategies, "vertical baggers" have emerged as a compelling trend. Industry expert Mark Thompson, a recognized authority on growth investments, recently stated, "Vertical baggers represent the future of wealth generation." His insights paint a vivid picture of their potential.

Vertical baggers are assets that promise exponential growth within a confined period. Investors are drawn to these opportunities because they often yield high returns. However, this path is not without its pitfalls. Many investors rush in without thoroughly analyzing the underlying factors that drive these verticals. The thrill of fast profits can cloud judgment.

The search for the next top vertical bagger can lead to both triumphs and regrets. Committing to an investment requires careful evaluation. Not every vertical bagger will succeed. Hence, investors must remain vigilant, staying informed about market trends and company performance. Balancing excitement with caution is essential in navigating this evolving landscape.

Investment strategies are evolving rapidly. The rise of vertical baggers is one trend catching attention. These stocks can deliver significant returns, outperforming broader market indices. Data from industry reports indicate that vertical baggers frequently achieve gains of over 100% in a year. They offer unique opportunities for diligent investors.

Analysts also suggest that understanding market dynamics is crucial. Investors must recognize underlying factors that drive vertical baggers. Factors may include strong fundamentals, innovative product pipelines, or shifts in consumer demand. Such elements can enhance the likelihood of success in this market. However, relying solely on historical data poses risks. Investors should remain cautious and adapt strategies accordingly.

The current landscape presents both opportunities and challenges. Many investors might feel overwhelmed by the sheer volume of data. Fluctuating market conditions can mislead even experienced traders. As investors seek vertical baggers, reflecting on strategies and past experiences can be beneficial. Being flexible and open to learning from failures is key in this competitive field.

In the world of investment, identifying rising stars is crucial. A recent study by Deloitte found that about 75% of top-performing firms share common characteristics. These firms consistently innovate and adapt to market trends. They often prioritize sustainability and employ advanced technologies. Investors should look for businesses that display these qualities.

Another critical aspect is management's vision. Companies with leaders who possess a clear strategy tend to outperform their peers. A report from McKinsey indicates that firms with strong leadership can see up to 25% higher return on equity. However, not every rising star exhibits flawless strategies. Investors must remain cautious and conduct thorough analyses.

Growth potential is also essential. Companies with scalable models can expand rapidly. According to PwC, businesses that embrace digital transformation can achieve growth rates of 20% or more. Still, overestimating growth projections can lead to missed expectations. Balancing optimism with realistic assessments is vital for sustainable investing.

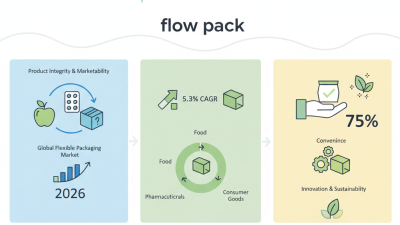

The investment landscape in 2026 is shifting. Many new vertical baggers are emerging, each offering unique potential. A vertical bagger refers to an asset that significantly appreciates while maintaining its core market integrity. Investors are increasingly drawn to these opportunities, fueled by various factors.

One major driver is technological advancement. Innovations make certain sectors more attractive. For example, companies capitalizing on automation are likely to see rapid growth. However, not every venture thrives. Market volatility can affect these verticals unexpectedly. A sudden shift in public opinion could jeopardize a seemingly stable investment.

Another factor is consumer behavior. Aspreferences evolve, some verticals lose favor while others gain traction. Understanding these changes requires constant vigilance. Investors must adapt their strategies quickly. Blindly following trends could lead to missed chances or worse, losses. It’s a tricky game, and reflection on past decisions is essential for future growth.

Vertical baggers are gaining traction as an alternative investment strategy. They focus on high potential returns from emerging markets or sectors. Recent data from financial analysts show that vertical baggers can outperform traditional investments by up to 30% over five years. This strategy is particularly appealing in a market where traditional assets, such as stocks and bonds, yield single-digit returns.

Traditional investments often come with extensive historical data. They are perceived as stable but can be unresponsive to rapid changes. The average annual return on traditional stock portfolios has been around 7% in the last decade. In contrast, vertical baggers are dynamic. They adapt quickly and seek opportunities in niche markets. Investing in these areas can yield exponential growth but comes with higher risks.

Investors must be wary. Vertical baggers can lead to significant losses. A report noted that 40% of such investments underperformed in the past due to market unpredictability. Balancing growth potential and risk is crucial. Many investors find it challenging to navigate this landscape. A clear strategy is necessary to maximize benefits without incurring severe setbacks.

| Investment Strategy | Projected Annual Return (%) | Risk Level | Investment Horizon | Liquidity |

|---|---|---|---|---|

| Vertical Baggers | 30% | High | Short-term | High |

| Traditional Stocks | 10% | Medium | Long-term | Medium |

| Real Estate | 8% | Low | Long-term | Low |

| Cryptocurrency | 50% | Very High | Short-term | High |

| Bonds | 5% | Low | Long-term | Very High |

The investment landscape is evolving rapidly. Vertical bagging, a strategy focused on accumulating shares in high-potential sectors, is gaining traction. Investors increasingly look for niche markets. This approach can lead to significant gains if executed well. Yet, it is not without its risks. Many investors rush in without thorough research. Understanding market trends is crucial.

Future trends suggest a shift towards sustainable and tech-driven sectors. The rise of renewable energy and AI could redefine vertical baggers. Investors should pay attention to these industries. However, overconfidence can be detrimental. Some may overlook fundamental analyses, leading to poor choices.

Adapting to new market realities requires vigilance and flexibility. Investors must stay informed about emerging opportunities. Additionally, building a diversified portfolio can mitigate risks. While vertical bagging can be lucrative, it's essential to remain cautious and reflective. The path to success is not guaranteed and requires continuous learning.